Monday 22 September 2008

GOLD: Bearish sentiment, bullish action? 2008-09-22

I was just doing an eBay listing from a template that I originally created on 22 September 2007.

Look at how the gold price has changed since then, even despite the bearish sentiment over the summer! Look at the devaluation of the Pound!

US$ gold price gone from 731 to 902 !

£ Sterling price gone from 361.81 to 485 !

This is despite all the bearish sentiment over the last few months - the bull market is over and all that stuff. Or maybe it is because of it. Gold has remained above 2007 levels on a year over year basis, except for maybe one or two monents in the low 700s a week or two ago. I shall try to find out whether it was ever down on a y-o-y basis in 2008.

So what anyway?

Clive Maund the well known gold analys is also a Genesis fan. See his US bond chart here:

Clive Maund Gold Market Update September 21st, 2008 and look for the one liner from'The Lamb' - what a man of taste! I am going to listen to 'Deep in the Motherlode' now!

Since Kitco has been down for maintenance (of John Nadler's BS commentaries perhaps), I have gone here to look at the gold price instead:

http://www.bullionvault.com/gold_market.do

and

http://www.bullionvault.com/gold-price-chart.do

The price is holding above $900 this evening, also at £486 Sterling, just over €610. The recent sharp upward move has taken the price back over $1000 Australian $, too.

To get this in perspective, £486 is £100 above the old 1980 high in Sterling around the £380 level. A gold Sovereign is worth £114 in melt. That used to be a pound coin, so since the Gold Standard was ended, the Pound has devalued by more than 99%. Thank you, Central Bankers.

Please see these eBay auctions:

NICE 1884 SYDNEY SHIELD GOLD SOVEREIGN OF VICTORIA

DECENT 1862 VICTORIA SHIELD GOLD SOVEREIGN NO RESERVE !

LOVELY 1898 MELBOURNE MINT GOLD SOVEREIGN OF VICTORIA !

CHOICE 1916 (London) Gold Sovereign - RARE on eBay

RARE 1899 PERTH MINT GOLD SOVEREIGN OF VICTORIA ! EF

Sunday 21 September 2008

US Bond Default imminent? 2008-06-21

Well, no emergency measures came this weekend from the Fed or the Bank of England, since they need to rest after spending most of last week on last weekend's emergency measures! Note that the emergency last week lasted from the previous Friday to the next Thursday, almost one full week.

The post-bailout stock market rally then came on Friday, thereby postponing the collapse for at least ... one more day.

Dow Jones Industrial Average Technical Chart ^DJI XC0009694206 Yahoo! Finance UK

and

FTSE 100 Technical Chart ^FTSE GB0001383545 Yahoo! Finance UK

In fact, the rally was pathetic, because all those rule changes barely manged to erase the losses of the previous 4 days in the week, let alone all those in the previous weeks and months! What rules can they change to save them next week?

Thanks to Yahoo! for providing us all with indispensible charts. Clicking the links above will take you to the 5-day chart, current to the day you are looking! The above charts are what was displayed this weekend and will be gone by Monday 22/9/2008. So might the banking system.

The newspapers and TV have trumpeted Friday's rally as a positive record event, failing to mention that it happened only because many of the rules of share trading and banking have been changed overnight. It is basically a large short-covering rally, since much of short selling has been banned altogether on a huge number of (financial) stocks in a bold fascistic move that Hitler or Mussolini would have been proud of. (Actually, I don't think that Hitler would have been proud of such a move. He certainly would have had something to say about a bunch of bankers running the Fatherland!) It is at times like these that we need to take a breath and compare last week's events to other momentous ones in history.

At any rate, we witnessed the end of free markets in the Western world last week. They were already highly manipulated anyway by a fascist/socialist alliance of government, central banks and some highly favoured private banking corporations. Now at least that truth is more or less out in the open. It is done for private gain in the boom and the socialisation of losses in the breakdown (i.e. the bankers gain in the good times, then the taxpayer pays for any losses). Isn't that fascism? Please someone tell me if it isn't.

I feel it in my bones that the USA will default on its sovereign debt and may do so soon. Perhaps the pre-inauguration period may be a suitable time to do this. So to my list of 10 items in the previous post I might add:

11. USA receives a credit downgrade and/or defaults on its sovereign Treasury debt, with all the consequences that it entails.

See the excellent charts by Clive Maund at these two links:

US TREASURY BONDS - major reversal believed imminent...

and

THE BAILOUT PLAN - what does it mean? - especially for gold and T Bonds...

I just love those Dojis candlesticks!

Introduction to Candlesticks - StockCharts.com

I also saw Rick Ackerman's commentary about Friday's rally. He doesn't think much of it at all:

614-Point Rally A Patent Fraud (with a telling chart)

and

Why Mega-Bailout Is Destined to Fail

Since the US financial system is so incestous, it is unlikely that anyone inside the USA will downgrade US debt until it has already defaulted, either through (1) Outright failure to pay default or (2) Hyperinflation and currency devaluation Zimbabwe style.

To think that Zimbabwe knocked 10 zeros off all its banknotes! The highest value banknote was 100 billion Zimbabwe $ (which would buy a loaf of bread or thereabouts) and that became 10Z$.

Bringing this to reality would mean that, if you were a BILLIONAIRE and you stored your money under the mattress for the last 5 years, you would have come out with 10 cents!

Maybe you could buy a stick of chewing gun with that.

I was actually thinking of outright US default (i.e. 'can't pay, won't pay') as the outcome. I am not sure that the convenient way will occur.

The best situation for the USA is to have very high inflation to allow it to make a gradual default on the debt. The next best is to have outright hyperinflation with no actual formal default (i.e. debts technically paid but in extremely depreciated dollars) and the worst humiliating case would be actual default, the failure to pay interest on bonds issued. This could happen if there is a run of US bonds and the yield (interest rate) spikes very high. A run of US bonds could collapse the currency too and result in default and then hyperinflation due to the consequent US$ devaluation, which would be the famous double whammy.

No-one would want the interest on the debt then, because the US$ would be worthless anyway and no-one would want to receive US dollars at all, in exchange for anything. That is the time that some oil exporters might demand gold payment from America for oil and we might all find out at last how much gold, if any, is actually in Fort Knox - or whether it has all been leased out to suppress the gold price to give the impression of a strong US dollar in the last decade or so, as GATA bravely claims.

If the US were to issue a new currency to pay for its oil imports, a full audit of US treasury gold would surely be demanded by its creditors.

Friday 19 September 2008

Systemic bank collapse -> Dictatorship? 2008-09-19

In the end, what conclusion can we draw from all of this?

1. The entire US/UK financial system is broke, busted, caput.

2. The rescues and manipulations of this last week are quite extreme and they attest to the above.

3. The true state of affairs is being hidden from public view to prevent a panic and runs on all major banks in the Western world.

4. The Fed and the Bank of England know this and the current rescues have been to conceal the truth long enough to reach the upcoming US election (if there is one) before the collapse happens.

5. The collapse is likely to be timed after the presidential election (if there is one) and before the inauguration of the next president (if there is one).

6. During this time, the current leaders will take emergency powers before any handover that may take place.

7. Whoever is in the White House by 20 January 2009 will have dictatorial powers and...

8. We will be in the midst of a second Great Depression by 20 January 2009.

9. The collapse could actually happen sooner because the wheels have already fallen off the wagon.

10. I would not be that surprised if the 2008 US election is postponed, perhaps indefinitely and there could be a fascist dictatorship by year end.

Broken banking system + market manipulations 2008-09-19

Broken banking system plus market manipulations.

To say that they 'cannot be allowed to fail' defines that they are above the law!

The past week has been a most eventful one in the financial markets, the most eventful since The Great Depression.

1. Lehman Brothers is busted and in Chapter 11 'Bankruptcy Protection'

2. Merrill Lynch had a 'shotgun wedding' takeover by Bank of America.

3. AIG had an 84bn$ rescue from the Federal Reserve courtesy of the unconsulted taxpayer.

4. Lloyds TSB High Street UK Bank bought of HBOS, another UK High Street bank.

5. The USA and UK have banned short selling of stocks, at least the stocks of favoured corporations, i.e. the banks and investment houses.

6. The regulators in the USA raised the margin requirements to punitive levels in gold and silver, to discourage people from investing in gold and silver.

It is a cornucopia of market manipulations and fascistic alliances designed to protect the banking elite at the expense of the public and against anyone who is an ultimate creditor of these organisations (or the equally busted US or UK governments).

Introducing these rules that have not been in force since the 1930s Depression, if ever, has bought some time (a little) by rallying the markets temporarily.

The authorities have ignored the fact that some investment banks have previously made billions by short selling industrial companies and commodities over the past century. Now those very culprits are being protected from astute investors who are betting that these institutions are already bankrupt in all but name. Short selling is a pricing mechsnism. Why should it be banned now? Some investment banks have previously indulged in 'naked short selling' which has always been illegal - but the regulatory authorities turned a blind eye. Some small and middle-sized but strategically important industrial companies have allegedly been more or less financially destroyed by these 'investment' practices - but the law was never enforced upon investment banks profiting from this practice.

They were and are above the law and cannot be allowed to fail. To say that they 'cannot be allowed to fail' defines that they are above the law, i.e. the law is made specifically for their benefit and against the interests of citizens and against the interests of entrepreneurs everywhere.

This is the absolute proof of the fascist business and government model rampant in the USA and the UK. They are now able to be defined correctly as fascist regimes and not democracies, free republics or anything else. Of course, the Iraq war and the immoral occupation of that country was already enough evidence of that. Qui bono?

These most recent actions in the markets have been purely to buy time for a Wall Street rally to enable one last chance for the insiders (and outsiders) to sell those banking stocks, so the elite can move their money away from a system that is almost certainly going to fail systemically very soon. Short selling is banned but selling isn't, so astute investors can liquidate their holdings of banking stocks and walk away. That is unlikely to be banned by law, at least not yet!

It is possible that some of the banks have been short selling their competitors to force them into mergers at extremely disounted prices and the new law was enacted to prevent this kind of vulture behaviour and monopoly formation. That would be the more innocent explanation but it doesn't change the details of the corruption that has gone on and the illiquidity and likely insolvency of the banking system that seems to be getting more exposed for all to see.

So why raise margin requirements on gold and silver now, when gold is still well below its March 2008 high of $1030? There is no innocent explanation for that. It is sheer government and central bank market manipulation to protect the SHORT SELLERS in the precious metals at the same time that no-one is allowed to short sell banking stocks. WHAT IRONY!

As economics expert Jim Sinclair of multi-decade experience implores us to protect ourselves, so we should, by being as far out of the financial system as we can possibly be and removing as many intermediaries between ourselves and our assets as possible. Preferably to remove all intermediaries, which means direct ownership of physical assets that cannot be lost by bankruptcy of financial institutions. This involves coming out of Babylon, as spoken of in Revelation Chapters 17 and 18. The fall of our financial Babylon is at hand. Those two books in the Holy Bible should be read by everyone, religious and athiest, including Richard Dawkins, because they described incredibly accurately 1900 years ago, what is happening today. Our modern Babylon is the Dollar Standard System of banking, usury and theft as practiced by Britain's and America's ruling classes.

Alistair Darling, the UK Chancellor of the Exchequer (that is, Finance Minister) on television last night on the programe 'Newsnight' basically admitted that the takeover by Lloyds TSB (an already merged pairing of banks: Lloyds and TSB) of HBOS (Halifax Bank of Scotland - another company made up of two previously merged banks) broke the rules on Monopolies and mergers (known as anti-trust laws in the USA) but that the consequences of not allowing the merger at this time would have been 'very serious' for the financial system. Serious consequences would have followed and we all know what that means (Saddam certainly found out)!

What can you read from that? HBOS was broke and they were taken over at a fire sale price to conceal the fact that a major UK high street bank was bankrupt, perhaps? This entity wasn't Northern Rock. In years gone by, when I lived in Aberdeen in 1989, the Bank of Scotland used to issue its own currency notes in Scotland! It's not a piddling little ex-building society like Northern Rock was. HBOS was a major institution.

In the end, what conclusion can we draw from all of this? My conclusions are:

1. The entire US/UK financial system is broke, busted, caput.

2. The rescues and manipulations of this last week are quite extreme and they attest to the above.

3. The true state of affairs is being hidden from public view to prevent a panic and runs on all major banks in the Western world.

4. The Fed and the Bank of England know this and the current rescues have been to conceal the truth long enough to reach the upcoming US election (if there is one) before the collapse happens.

5. The collapse is likely to be timed after the presidential election (if there is one) and before the inauguration of the next president (if there is one).

6. During this time, the current leaders will take emergency powers before any handover that may take place.

7. Whoever is in the White House by 20 January 2009 will have dictatorial powers and...

8. We will be in the midst of a second Great Depression by 20 January 2009.

9. The collapse could actually happen sooner because the wheels have already fallen off the wagon.

10. I would not be that surprised if the 2008 US election is postponed, perhaps indefinitely and there could be a fascist dictatorship by year end.

Tuesday 19 August 2008

Kitco shortage and bear commentaries! 2008-08-19

At the sametime as Kitco announces a shortage of all bullion products on their website, there goes their mouthpiece John Nadler again, talking gold down. This guy has to have an agenda. Is he short gold?

Gold is down a long way BUT it is still 20% up on a year ago. Nowhere does he mention this; he just pounds the bearish case as always.

As the Kitco front page says as of now,

"1yearchg +137.40 +20.94%"

They should get another gold analyst. I am sick of this guy. Why buy any gold when dealers have this kind of guy as an “analyst.” He is acting against the interests of those who buy gold from his company.

He has also totally failed to mention the shortage that has been announced on their site. There have been corrections before but not a shortage like this. However he mentions only the correction - it suits his bear case and not the shortage, which is a far rarer and more newsworthy event.

Friday 15 August 2008

Proof of manipulation? 2008-08-16

Some advocates of gold and silver investment have made much of the alleged lack of silver supply. Some bullion dealers ran out of finished product (1oz coins and small bars) but John Nadler of Kitco repeatedly stated that you could trip over piles of 1000-ounce bars in the vaults around the world.

Now tonight, this notice appeared on http://www.kitco.com/ - in red 'ink':

"IMPORTANT NEW NOTICE: Due to market volatility and higher demand in the entire industry, we are anticipating delays in supply of all bullion products. Please note that you can continue to place orders and prices will be guaranteed; however, cancellation fees will still be applicable regardless of the length of the delay. Consequently once inventory is received there may also be delays in processing and shipping by our vaults."

This clearly states that there are shortages of ALL BULLION PRODUCTS with respect to real demand. (Or does it?) So why is the price of gold down 8% for the week at $786 and silver down a great big chunk at $12.70 at the end of this week?

Only one answer is possible: The price is set by the paper markets only. Nadler may have been correct when he previously stated that the 'clearing price' for real physical gold was $740 or not too far from there. Maybe the clearing price for physical gold is where we are now, at about $780: when reached, the vaults clear. Maybe they have? Or maybe not? Who knows in this world of fraud and illusion?

It also implies that the run up from $730 to $1020 was all paper speculation and 'froth' - including the buying of ETFs, futures, options, swaptions and all that nonsense. Perhaps the ETFs have little or nothing to do with the physical market after all? I'm sure that futures and options have little or nothing to do with the physical market. Does anyone ever take delivery? Can anyone ever take delivery?

Well, maybe today people have started to take delivery of these 'contracts' or maybe someone has just placed a real order for real metal.

The paper markets seem to be just a means for governments and finance houses to 'earn' commissions and/or short the market using someone else's property.

Imagine if you were short gold at $920 a couple of months ago and then saw it jump to $980 in a matter of days. Maybe you bailed out with a huge bankrupting loss, thinking that the price is going to $1200, only then to see the 'market plummet to $786 and your original (now closed) position hugely profitable. What irony. What a joke! Jim Sinclair of http://www.jsmineset.com/ has often said that using margin in gold is dangerous.

The question is, at $786, should I sell any real gold that I bought at $300, before it might go back to $300?

Answers on a postcard please.

Monday 11 August 2008

Targets met! What now, 1974? $550? 2008-08-11

It's 9 years since the total eclipse of the Sun in England (where it rained, of course) on 11 August 1999. Today gold is being eclipsed and rained on in no uncertain terms, together with most of the commodities.

Did you read anywhere else of downside targets in the $840s from a Head and Shoulders pattern? Or were most or all the 'tout' commentators talking their books, telling you to buy at $880 despite this most obvious chart pattern, as obvious as it gets.

My downside target(s) of $861 and $844 have both been met and exceeded. In fact, the $844 target even allowed for more or less holding around the old all-time high of $850. However, the price plummeted from the $860s and sliced through this lower $844 target all the way to $820, without any pause around $850 at all. Even I didn't really expect that, although $844 is below the previous recent lows (the lowest at $846.40) and below the 21/1/1980 all time high ($850), which might suggest further breakdown(s). It might however also have indicated a possibility to abort the H&S in the $850s, but no such luck!

If we get a bounce at around $800, the chart will form a downtrend channel with two tops and two bottoms (see below).

I had thought the Point and Figure chart (see stockcharts link below) was looking a bit weak and stuttering in the uptrend. I see now that there is a descending triple bottom breakdown from 5 August 2008.

Note also the magnificent double top in the Gold:S&P500 ratio at the bottom of this weekly chart:

http://stockcharts.com/charts/gallery.html?%24gold

James Turk was on Jim Puplava's show some weeks ago, saying that 2008 resembles 1974 in many ways. He then came up with his targets for gold at $1500 spike in 2008 and ending the year at $1100-$1200. What he didn't mention was that 1974 was the start of an intermediate term 18+ month bear market when gold fell from $195 to $103 (not far off -50%). If this is 1974 again, get your flares out, put on the last Peter Gabriel Genesis double concept album from that year and wait for $550 gold!

Now, consider if the gold:S&P500 double top formation were to break down:.

The above is a log graph so I shall do the calculation geometrically (with ratios) and arithmetically (by differences) and use today's close of the S&P500 of 1305.32 to convert the gold:SPX ratio into a gold price target:

Geometric:

0.784/0.598=1.311 (measured move ratio)

0.598/1.311=0.456 gold:SPX target.

0.456*1305.32=$595.22 gold target

or

Arithmetic:

0.784-0.598=.0.186 (measured move amount)

0.598-0.186=0.412 gold:SPX target.

0.412*1305.32=$537.79 gold target -

WOW! That's the 45+% retracement like 1974-1976!

http://www.cbsnews.com/stories/2007/03/07/business/marketwatch/main2543127.shtml

"And I'm hovering like a fly, waiting for the windshield on the freeway ... "

Friday 1 August 2008

Head & Shoulders breakdown for gold? 2008-08-01

Well, it sure looks like a Head and Shoulders pattern breakdown to me! Either that or so-called 'Technical Analysis' ('TA') is just aload of waving your hands about psychobabble nonsense, so that 'technicians' can sell subscriptions for worthless investment advice that is denied as being investment advice, (i.e. the kind that often comes with the typical disclaimer saying, "In no way is this investment advice ... we are not liable for any trading losses as a result of this advice that isn't advice ... BUY! No, SELL, SELL! No, BUY! Buy my newsletter! That will be $500 a year, thank you. Cheque, PayPal, Credit card or Bankwire are fine.")

See the excellent and free gold futures charts submitted by Dan Norcini (better than many of those from people who charge loads) at http://www.jsmineset.com/ - downloadable as Acrobat Reader .pdf files on most days. (The bigger writing on the snapshots below was added by me.)

A couple of days ago, prepare for swan dive:

One day ago, swan dive duly arriveth:

The daily spot gold '$GOLD' stockcharts chart looks slightly less alarming but is a neckline breakdown by any standards, on an intraday and closing basis:

If that ain't a head & shoulders, then there ain't no such thing as a Head and Shoulders, except for the shampoo of a similar name.

Of course, then the 'debate' will be: 'By how much?' 'When is a breakdown not a breakdown?' and all that similar nonsense that we always here when 'Technical Analysis' doesn't work and the expensive hired tealeaf readers get it wrong.

It's interesting that the $844 and $861 possible targets are near to two recent lows (support areas) in the above chart.

For development of this, see the current chart, constantly updated at http://stockcharts.com/charts/gallery.html?%24gold!

It will be interesting to see if this formation gets negated next week or if we do get a continuation of the breakdown to the $844-861 target and another chance for any interested buyers to purchase the yellow metal in the $850 area.

Thursday 31 July 2008

H&S Breakdown for now? 2008-07-31.

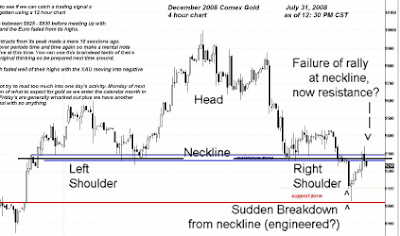

Dan Norcini's chart a couple of days ago showed what looked like a classic Head & Shoulders with a price target of ... $844 on an intraday basis: top-neckline = $990-$917=$73, so the measured move is $917-$73=$844. Oops!

http://www.jsmineset.com/cwsimages/Miscfiles/6406_July2908Gold1230pmCDT.pdf

As I said, a chart just ripe to be 'painted' lower by those who wish to imply that the economy and inflation are under control by bashing the gold price.

Anyway, on his 4-hour chart today:

http://www.jsmineset.com/cwsimages/Miscfiles/6415_July3108Gold1230pmCDT.pdf

the right shoulder broke down suddenly, just as if there was an engineered technical breakdown by the short sellers. The price bounced back to the neckline as resistance and not much , if any, beyond it.

As I write we are Bid/Ask $918.50 - 919.10 on the spot market Kitco, right on the neckline. Actually the intraday spot price went to $929.40. The range was Low/High $911.70 - 929.40 and over the day's trading there was a gain of only about $2: Open/Last $917.90 - 919.50. See www.kitco.com !

The right shoulder of the H&S has also now formed and broken down on the daily spot gold chart on the stockcharts gallery view:

http://stockcharts.com/charts/gallery.html?%24gold.

Looks weak, doesn't it?

Moving out to the weekly chart in the stockcharts gallery view, it looks a bit like a cup and handle formation; that's more bullish. The Point & Figure chart, the uptrend is slipping a little bit, looks mediocre. "I'm OK, you're so-so," as Bowie sang.

Don't you just love technical analysis? James Dines said he called it 'Visual analysis' - in other words, I guess he doesn't think there is anything very technical about it, especially since all the moving averages are calculated for you these days and displayed almost instantaneously on a computer chart. So it is just reading tealeaves, isn't it?

Wednesday 30 July 2008

Beijing 2008. Think Sputnik 1 1957. 2008-07-30

Emanuel Balarie says here on Kitco:

China, Jim Rogers, And Commodities

"In Shanghai for instance, you can jump on the world’s first Maglev train that will take you from the airport to downtown Pudong/Shanghai in record time. Since the train travels at about 430 km/hour, the typical 45 min trip (via car) will only take you about 8 minutes."

Coincidentally, this Monday, two days ago, I was in my local "Works" bookstore and saw a £5 book about China that had a picture of the Shanghai MagLev train in it. Eric Laithwaite was a figure who appeared on British television when I was a child.

As Wikipedia says, "In the 1960s, Great Britain held the lead in maglev research;[1] Eric Laithwaite, Professor of Heavy Electrical Engineering at Imperial College, developed a functional maglev passenger vehicle. It weighed 1 ton (1 tonne) and could carry four passengers."

"Eric Roberts Laithwaite (14 June 1921 – 27 November 1997) was an English engineer, principally known for his development of the linear induction motor and Maglev rail system."

Read about them here:

Maglev (transport) - Wikipedia, the free encyclopedia

Eric Laithwaite - Wikipedia, the free encyclopedia

The Incredible Genius Of Eric Laithwaite

However, we British were never treated to a public MagLev train, not ever, and are unlikely to get one soon, if ever.

This explains the difference between the culturally, economically, morally and in every other way dying Britain and the up and coming China.

My take on it is this:

The British, American and other Western media have virtually boycotted the Chinese 2008 Beijing Olympics for the last year, with flimsy excuses containing all the usual criticisms of China from previous decades dredged up for this occasion. Eight days to go and we finally get a mention on the BBC news of their webpage for the Olympics here. BBC SPORT Olympics.

The result will be like this (if we are allowed to see any of China during it):

The Beijing Olympics, will be the equivalent of the launch of Sputnik 1 by the Soviet Union on 4th October 1957, nearly 51 years ago. It will hit home, hard, especially because we ourselves have entered the start of a deep recession, housing crisis, banking crisis, asset deflation crisis and fuel price and general (hyper)inflation crisis at home.

Tuesday 29 July 2008

Head & Shoulders. So much for $8000+ gold! 2008-07-29

Here is trader Dan Norcini's latest gold chart (short term):

http://www.jsmineset.com/cwsimages/Miscfiles/6406_July2908Gold1230pmCDT.pdf

It shows to me what looks like a classic Head & Shoulders with a price target of ... $844 on an intraday basis:

top-neckline = $990-$917=$73, so the measured move is $917-$73=$844.

Oops! It looks like a chart just ripe to be 'painted' lower by those who wish to imply that the economy and inflation are under control by bashing the gold price.

However on the daily chart, the right shoulder is not yet formed:

http://stockcharts.com/charts/gallery.html?%24gold

Maybe we need to wait a little while before making any conclusions.

Friday 18 July 2008

$8387.96 Gold & US Balance sheet #2! 2008-07-18

This gets more fascinating. I have found another webpage, this time on the St. Louis Fed website, giving foreign holdings of US debt. It's called:

'Federal Debt Held by Foreign & International Investors'

here:

http://research.stlouisfed.org/fred2/data/FDHBFIN.txt

The data gives the total foreign owned Federal debt calculated every 3 months since 31 March 1970 and doesn't quite tie in with all the data I had on the previous blog entry.

The US Gold Reserves figures are taken from this document in the public domain:

www.gold.org/assets/file/pub_archive/pdf/Rs23.pdf.

Again, I am going to do the calculations the same way but this time assuming that the debt data is consistent because it is all from the same page linked above:

Calculations: (1 tonne = 1 million grams. Need to x1,000,000/31.104 to get troy ounces: that factor is about 32150 troy ounces per tonne.)

Total debt / US gold reserves (tonnes) / 32150 = price of gold 'needed' to balance the debt using the gold reserves as collateral, as per Jim Sinclair's idea on http://www.jsmineset.com/ :-

1970:

Total foreign holdings of Federal debt = $12,400,000,000

US Treasury Gold holdings = 9839 tonnes

Gold price to balance debt = 12,400,000,000/9839/32150 = $39.20/oz.

Actual average price for 1970 was $35.94, so VERY CLOSE TO FAIR VALUE.

This was before Nixon closed the gold window and 'floated' / 'sank' the US$.

1971:

Debt ballooned!

Total foreign holdings of Federal debt = $31,800,000,000

US Treasury Gold holdings = 9070 tonnes

Gold price to balance debt = 31,800,000,000/9070/32150 = $109.05/oz.

Actual average price for 1971 was $40.80, so way undervalued (by 62%).

Debt figure is for 30 June 1971. Nixon closed the gold window soon afterwards.

No wonder! The dollar needed to fall and the gold was disappearing with 769 tonnes lost in 1971.

1974:

Total foreign holdings of Federal debt = $56,800,000,000

US Treasury Gold holdings = 8584 tonnes

Gold price to balance debt = 56,800,000,000/8584/32150 = $205.81/oz.

Actual average price for 1974 was $159.26, so slightly undervalued.

1978:

Total foreign holdings of Federal debt= $119,500,000,000

US Treasury Gold holdings = 8584 tonnesGold price to balance debt = 119,500,000,000/8597/32150 = $432.35/oz

Actual average price for 1978 was $193.19, so 55% undervalued.

1980:

Total foreign holdings of Federal debt= $118,200,000,000 (down on 1978 - thanks Mr. Volcker!)

US Treasury Gold holdings = 8221 tonnes

Gold price to balance debt = 118,200,000,000/8221/32150 = $447.20/oz

Actual average price for 1980 was $612.56, so 37% overvalued (and 98% overvalued at the 1980 futures top of $887.50 by this method).

1984:

Total foreign holdings of Federal debt= $171,600,000,000

US Treasury Gold holdings = 8174 tonnes

Gold price to balance debt = 171,600,000,000/8174/32150 = $652.97/oz

Actual average price for 1984 was $360.48, so 44.8% undervalued.

Note that the calculation is getting close to the 1980 highs.

...

2007/08:

Total foreign holdings of Federal debt= $2,193,400,000,000 (massive)

US Treasury Gold holdings = 8,133.5 tonnes

Gold price to balance debt = 2,193,400,000,000/8,133.5/32150 = $8387.96/oz

Actual price for 18 July 2008 is $948.80 after being beaten down a bit, so 11.3% of fair budget balancing value, i.e. 88.7% undervalued.

So this set of data agrees with the previous set, on a fair value of $8000+ per ounce for gold.

You can see also that at some point gold was overvalued (by a factor of 2 in January 1980), and was close to fair value in 1970, which gives this analysis some credence I think.

One might even say that gold was actually undervalued in the period around 1970, because the French were in a hurry to swap their trade surplus $ for gold at that time!

By this analysis, fair budget balancing value of $8000 is implied.

Estimate gold market @ $8355+! 2008-07-18

Jim Sinclair had a prediction in 1974 for a bull market high of $900 for gold on this basis, quoting from his website article on http://www.jsmineset.com/ dated 2008-07-17:

"In 1974 I concluded gold would rise to $900. That number represented the price gold would have to be at, times the amount of gold published as held for the US Treasury to balance the value, at par, of US Treasury debt held internationally. This would be balancing the international balance sheet of the USA.

The trick is analyzing what the international debt of the US is, both directly and implied. The number in 1974 was $900. I will not tell you the number today. It is absolutely scary."

It is not easy to find the correct figures to reconstruct Jim Sinclair's forecast from 1974.

However, here are some useful pages concerning US debt owned by foreign countries and US gold reserves:

MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES US 2007-08

http://www.treas.gov/tic/mfh.txt

US Treasury: Treasury International Capital System Cross-Border Portfolio Holdings of Securities

http://www.treas.gov/tic/fpis.html

Foreign Portfolio Holdings of U.S. Securities as of 6/30/2007 (klarge file (Use Right click Save Target As)

http://www.treas.gov/tic/shl2007r.pdf

2008 Press Release revision of above:

http://www.treas.gov/press/releases/hp947.htm

Historic foreign debt & equity holdings 1974-2008

http://www.treas.gov/tic/shlhistdat.html

The United States Bullion Depository Fort Knox, Kentucky

http://www.usmint.gov/about_the_mint/fun_facts/index.cfm?flash=yes&action=fun_facts13

says:

Highest gold holdings 'this' (20th) century: 649.6 million ounces (December 31, 1941).

Amount of 'present' gold holdings: 147.3 million ounces. (Not sure of date. This is less than the total offical US gold reserves, see below.)

It also says, "The Depository is a classified facility. No visitors are permitted, and no exceptions are made."

Wikipedia (very useful and easy to see as usual!):-http://en.wikipedia.org/wiki/Official_gold_reserves

World official gold holding (June 2008) - original source World Gold Council:

World 29,813.1 tonnes

United States 8,133.5 tonnes ... (261.49 M oz)

Venezuela 356.8

United Kingdom 310.3 (less than Venezuela, thanks to dickhead Gordon Brown)...

(Although the United States has the largest reserves of individual countries, in total the eurozone gold holdings are greater (11,065 tonnes as of December 2007).)

Central Bank Gold Reserves An historical perspective since 1845 by Timothy Green

www.gold.org/assets/file/pub_archive/pdf/Rs23.pdf

This gives US gold reserves in USA as 8584 in 1974 and 8544 in 1975 (tonnes of gold).

World Gold Council latest information on gold holdings:

http://www.marketknowledge.gold.org/ (requires username and password)

Historical gold prices (see yearly charts and data):

http://www.kitco.com/charts/historicalgold.html

Get your pocket calculators out!

Some of these US Treasury statistics seem to specify market value rather than 'par' value. Also, some include long and short term debt, some separate them. It doesn't really specify whether these are 'official' government holdings or if they include private institutional/investor holdings too. Some include other figures such as corporate debt and stocks and shares ('equities'), so the exact figures that Jim Sinclair would have used are not easy to find.

Calculations:

(1 tonne = 1 million grams. Need to x1,000,000/31.104 to get troy ounces: that factor is about 32150 ounces per tonne.)

Try for 1974:

Total foreign holdings of US Treasury debt (long+short term)= $42,427,000,000

US Treasury Gold holdings = 8584 tonnes

Gold price to balance debt = 42,427,000,000/8584/32150 = $153.73/oz

Unfortunately that is not Jim Sinclair's $900 prediction!

However, gold was quite close to this price in 1974! It topped at $195 and then declined to $103 before taking off again in the late '70s. Actually on the first trading day of 1975 (2 January), where Kitco's data begins, the London PM Fix gold price was $175.00. The Yearly average for 1974 was $159.26. how close is that? Within 5%! So it seems a very reasonable estimate. The debt had increased a lot by 1978 predicting a higher gold price as the 1970s went on. So let's continue on that basis... using data from these pages:

http://www.treas.gov/tic/shlhistdat.html and www.gold.org/assets/file/pub_archive/pdf/Rs23.pdf.

Try for 1978:

Total foreign holdings of US debt (long term) = $42,427,000,000

US Treasury Gold holdings = 8584 tonnes

Gold price to balance debt = 50678000000/8597/32150 = $183.35/oz

Again, gold was quite close to this price in 1978! Actually this estimate is a bit low if anything. The 1978 range for gold was $160.90 to $242.75. Year average was $193.19/oz.

Try for 2008:

Total foreign holdings of US debt (long term)= $2,185,000,000,000

US Treasury Gold holdings = 8,133.5 tonnes

Gold price to balance debt = 2185000000000/8133.5/32150 = $8,355.84/oz.

I saw elsewhere an estimate of US short+long term Treasury debt held by foreigners as 1964928000000+229099000000=2194027000000 = S+L Treasuries = 2,194,027,000,000 2.194 trillion $, very close to the 2.185 Trillion that I used just above.

So this analysis gave a very reasonable estimate for the price of gold in 1974 and 1978 - and for 2008 gives a price necessary to balance the budget of the USA as being $8,355.84/oz!Actually I think that this 2008 figure is not equivalent to the 1970s figures. The figures given on the Treasury website are at different levels of detail and are broken down in different ways, making it tricky to pick the right one. I need to look at the total long term debt figure in my calculation for 2008, which is actually $6.006853 Trillion.

Recalculate for 2008:

Total foreign holdings of US debt (long term)= $6,006,853,000,000

US Treasury Gold holdings = 8,133.5 tonnes

Gold price to balance debt = 6006853000000 /8133.5/32150 = $22,971.45/oz!

It seems that gold was already balancing this part of the debt of the USA by rising from $35 an ounce into the $150-200 region by 1974. I think that Jim Sinclair's calculation must be using a wider description of debt ("both direct and implied," as he says).

If you want to give yourself a fit, you could try using the total foreign holdings equity+debt, which at the present time are $9.771725 trillion as of the Treasury 2008 Press Release linked above. (Possibly that's closer in principle to what Jim Sinclair meant in 1974 to get his $900 estimate.) :

9,771,725,000,000/8133.5/32150 = $37,368.87/oz. That's an 'outrageous' price! Or maybe we should say that the today's actual $959.75/oz London PM fix is an outrageously low price?

Now, another date for which data is found: 1984. I cannot find actual Treasury debt data for 1980.

Try for 1984:

Total foreign holdings of US debt (long term)= $163,228,000,000

US Treasury Gold holdings = 8174 tonnes

Gold price to balance debt = 163,228,000,000/8174/32150=621.12/oz

Again, debt was up a long way by 1984. Average gold price was $360.48/oz, so maybe a bit undervalued. The estimate is in fact very close to the average gold price in 1980 which was $612.56/oz. Fascinating!

Let's summarise, including the adjustment factor that might be needed to bring the actual price to meet the estimate. Note how close the 1974 and 1978 estimates are, using this data!

Summary:

Year, Estimate, Actual, Adjustment implied

1974, $153.73, $159.26 (annual average), x0.96

1978, $183.35, $193.19 (annual average), x0.95

1984, $621.12, $360.48 (annual average), x1.72

2008, $8355.84, $959.75 (17 July 2008), x8.71

or

2008, $22971.45, $959.75 (17 July 2008), x23.9

Since the 1970s figures using this model were both very close to the actual gold prices, these figures seem to imply more of a longer term 'fair value' for gold, rather than the price at a spike top such as the one in 1980.

THE END!

PS. I have found another webpage that might explain Jim Sinclair's 1974 $900 peak estimate! See next entry.

Tuesday 8 July 2008

Hyperinflation idea & key links! 2008-07-08.

Here is my idea of the magnitude of inflation we might expect. Afterwards, I give some links to key articles on hyperinflation that I have read in the last few years.

After listening to John Williams speaking about hyperinflation on the 5th July edition of radio.GoldSeek.com (2nd hour), I had an question, then an idea.

The question:

How could we calculate the magnitude of the possible upcoming hyperinflation?

The idea came the following night: look at how much money might need to be created to underpin the financial markets.

Suppose the mountain of financial derivatives was to collapse and the Federal Reserve had to print enought money to monetise it.

Money supply - Wikipedia, the free encyclopedia gives the M3 (broadest) money supply in the USA as 10.3 Trillion when it was last quoted in February 2006. At that time, the total notional value of outstanding derivatives was about 600 Trillion $ worldwide. More conservatively, perhaps we might try using total derivatives exposure of US banks first.

http://www.federalreserve.gov/releases/h6/hist/h6hista.txt for Fed M3 data

and

http://www.nowandfutures.com/key_stats.html for a reconstruction of M3 money supply to the present day, where it now stands at $13.5 Trillion.

OCC: Publications - Qrtrly. Derivative Fact Sheet tells me that the Total Notional Value of All Derivatives of US banks is about $180 Trillion.

To monetise these if they collapsed would take an increase in the money supply of 180/13.5 = 13.33x or 1,333%.

Initially, I used $10 Trillion for M3 and $500 Trillion to represent all derivatives outstanding worldwide at about that time in 2006 when M3 was last quoted. It gave an idea of how many dollars are out in the world versus the derivatives contracts. To monetise that lot would require an increase in the money supply M3 from $10T to $500T, an increase of 50x or 5,000%.

Interestingly, that would represent a 98% devaluation in the US dollar, which is about the same as the entire devaluation that has occurred over the last 75-100 years , since the inception of the Federal Reserve in 1913 and/or the US leaving the Gold Standard in 1933. Gold was $20.67 an ounce then and has recently been as high as $1030 per ounce, an increase of 50x or a devaluation of the $ against gold of 98%. Similarly for the British Pound. The gold Sovereign was a £1 coin originally but is now worth £108 in gold bullion value, a devaluation of the pound against gold of 99%.

So, after already seeing a 98% devaluation in the $ in less than 100 years, maybe we could see a 98% devaluation in the next 10 years, to write off the derivatives mess over the next decade. This also assumes that the derivatives don't increase even more (they are currently increasing far faster than the standard measures of money supply: M1, M2, M3, MZM, etc). I think Jim Sinclair mentioned that the total derivatives notional value worldwide has actually passed 1,000 Trillion (a US Quadrillion), which, versus 13.5 Trillion M3 would take a 74x increas in M3 to cover it, as of 2008.

Since the path of inflation would probably be unstoppable at that point, it might be possible to see yet another 98% devaluation in the $ in a single year to keep the trend going, and we would then be into a Weimar style hyperinflation with the $ going effectively to zero (perhaps along with many or all other currencies). Jim Sinclair doesn't expect the US to have the full Weimar experience of hyperinflation, whereas John Williams of Shadowstats does see this as the final outcome.

In any case, I see this quick calculation as being the one and only way to get an idea of the true potential of inflation needed to revive the financial system in the case of a systemic collapse being imminent. The only alternative would be to let the system collapse into a massive deflation. If they have already used as collateral for generation of credit, the magnitude of deflation that might occur if the 1,000T$ in notional derivatives were to be revalued to zero is quite alarming! Essentially, perhaps this 1,000 Trillion could be viewed as a form of money supply and if it was destroyed, the money supply would go from $1,000T to $13T (with only M3 remaining) perhaps overnight, nearly a 99% reduction. Hyperdeflation!

Some best links on the Hyperinflation topic:

A superb article by Julian Philips that I read a few years ago: The Quintessential Inflation - The Great Weimar Inflation (when the gold price by my calculation reached 76.5 trillion marks per ounce in 1923). Then I would recommend reading John Williams' Hyperinflation Special report linked below, straight afterwards.

There was also Howard Ruff's Kitco article, called hyperinflationary depression and here is the link to the excellent John Williams Shadowstats Hyperinflation Special report download page . This highly detailed Special Report is also linked from the front page of the excellent Shadow Government Statistics Home Page.

Here is a link to John Williams' indispensible Shadow Government Statistics » Alternate Data Series graphs.

Also, the excellent Jim Sinclair's MineSet is a key resource for talk on the derivatives debacle.

My own posts on inflation/deflation:

Hyperinflationary depression? 2008-04-26

Inflation/Deflation debate is BUNK! 2008-05-29

Chart hints at Financial Disintegration: 2007-12-23

Mega-move from Dow:Gold megaphone! 2008-06-04

Megaphone top in Dow:Gold ratio? 2008-06-03

Earthquake + inflation is more than 3%. 2008-02-07... (totally frivolous)

Happy inflating!

Thursday 3 July 2008

News: BoA/Countrywide and ECB. 2008-07-03

Bank of America takes over Countrywide and ECB raises interest rates.

2008-07-03 23:33 GMT

Well, it's been boring with gold consolidating so nothing to say. This blog isn't a running commentary. Let John Nadler at Kitco and the big financial news agencies waste their and your time by commenting on nothing all the time and telling you nothing of any use.

Today's news is worth mentioning.

I was putting on my new Favourite places after AOL managed to erase my old ones when I upgraded to their new network. I looked for Countrywide. It wasn't there on Yahoo Finance.

"Invalid ticker," it said. I then went to the news on Google and there it was: B of A took over Countrywide, as had been expected. Very quiet and buried under other news when it actually happened.

The other news: The European Central Bank raises interest rate by 1/4 point to 4.25%. The USA Fed is at 2%. What to expect? Euro should rise? Dollar go down? Gold go up possibly?

The opposite happened. Again the news agencies will find all kinds of spurious reasons why this was so. Do you want to waste your time reading them? I don't.

Wednesday 4 June 2008

Mega-move from Dow:Gold megaphone! 2008-06-04

Last time, I discussed the Megaphone Top Chart Pattern with regards to the Dow:Gold ratio. Look at that pattern at the link above and see if it is not almost exactly the same as the pattern of the Dow:Gold ratio in the last 70 years. Well, it is!

Now, time for the kicker. What's the measured move from this pattern breakdown? Note that it's said to be a bearish pattern. This is being calculated using at a Log scale chart.

The measured move, as often the case, is from the breakdown point downwards, by an equal amount to the distance from the points where the price hit the upper and lower trend channels on the last previous occasions, (according to the explanatory link above).

This is what it looks like for the Dow: Gold ratio:

That would give a Dow:Gold ratio of 0.0114:1 or put another way, a Gold:Dow ratio of 87.75 to 1; about 88:1.

Now that would be a turn up for the books.

"Impossible!" you say? Think 1923 Weimar Germany. What did they get? One million marks an ounce, one billion marks an ounce, one trillion marks an ounce? Where did it stop?

Here is a super article by Julian Philips that I read a few years ago: The Quintessential Inflation - The Great Weimar Inflation.

The answer to the above question is in Table 7 of that article. The table is entitled 'Desperation' - an exchange rate of 18 trillion marks to the British pound. Britain was on off the gold standard in 1923 but back on in 1925 and issuing gold Sovereigns with 0.2354 ounces of gold, so let's use that figure. The mark:gold exchange rate was 18 trillion / 0.2354 = 76.5 trillion marks per ounce!

Could we safely ignore this Dow:Gold ratio pattern? Well, I don't think so, unless you dump the entire idea of technical analysis of market charts in the trash can.

One feature of the Dow:Gold ratio is that it is not affected directly by currency debasement - both the Dow and Gold are measured in US dollars, so debasement of the dollar is cancelled out in the ratio. The trend is therefore not skewed as with stock and bond price charts by changes (usually drops) in the value of the currency in which they are measured. The Dow:Gold ratio is 'dimensionless' as a scientist would say, i.e. it's not valued in US$, but it's a pure ratio. Perhaps technical analysis is more valid in this case, rather than less?

Text Copyright 2008. D. Bellamy.

Tuesday 3 June 2008

Megaphone top in Dow:Gold ratio? 2008-06-03

In this entry I am going to repeat a lot of the previous entry because I wanted to draw attention to the pattern of the Dow:Gold ratio again. Today, I have just found a fascinating entry on the internet on the Trade Talk Weekly website, concerning the Megaphone Top Chart Pattern.

Look at that pattern and see if it is not almost exactly the same as the pattern of the Dow:Gold ratio in the last 70 years, then read the rest of my entry, especially point 3 near the end, repeated from the last blog article. The above website would suggest a breakdown at the next visit of Dow Gold to the 1:1 ratio, which might imply a long period of decades to follow with a ratio of less than 1:1!

Not every mention on the internet of the megaphone chart pattern correlates exactly with this but in any case I shall draw it here:

We have entered into a period, shown by the increasing and extreme amplitude of oscillation of the Dow Jones stock index to Gold ratio, where it is becoming impossible to value anything in terms of money, or even in terms of anything else. The entire economic system is completely broken. Many say that the Dow:Gold ratio measures values of paper assets vs real assets. I think that it is only part of the story. In fact, the Dow stocks represent real companies and real productivity and are therefore semi-tangible. Although the stock prices are based on 'faith' or confidence in those companies and are paper assets, their values are also governed by sales, profits, cash dividend payments and other 'real' assets of those companies such as real estate, plant and equipment.

The wild oscillation of the Dow:Gold ratio from 1:1 in 1980 to 43:1 in 2000 is a change by a factor of above 40! This means that, in a fiat money system, the value of one asset is not knowable in terms of another asset within a factor of 40! This is outrageous in a so-called 'stable' economy and is proof positive that the economy is not stable. I think that this huge volatility is a key factor that has been ignored.

Note from my previous blog entries (Chart hints at Financial Disintegration: 2007-12-23) that the instability began in the 1920s, shortly before the USA went off the Gold Standard, but after World War I when many industrial nations had already left the Gold Standard (such as England in 1914). Coincidence? I think not!

Contemporary with this was the Hyperinflation in Germany of 1923 and a short re-emergence of the Gold Standard in England in 1925, unsustainable because of highly inflationary policies during that period.

The 1920s stock market bubble is what led to the first major off-trend high on the chart - and the major low that followed is the early 1930s 90% crash in the Dow Jones, which was followed by the seizure of private gold by Roosevelt in 1933 and the subsequent 40% US Dollar devaluation from $20.67 per ounce of gold to $35 per ounce.

The 1920s stock market bubble is what led to the first major off-trend high on the chart - and the major low that followed is the early 1930s 90% crash in the Dow Jones, which was followed by the seizure of private gold by Roosevelt in 1933 and the subsequent 40% US Dollar devaluation from $20.67 per ounce of gold to $35 per ounce.The above chart is my adaptation of the Dow-Gold since 1800 sharelynx chart, with thanks to Nick at sharelynx for permission. The full sized edited chart with trendlines was here, until AOL closed down their webpage hosting in early 2009!

The bottoms of the Dow:Gold ratio in 1933 and 1980 represent major recessions/depressions, one deflationary and one inflationary. The ratio is oblivious to which. The three tops in 1929, 1966 and 2000 represent the euphoria of stock market/financial manias, regardless of the level of inflation at the time, although they probably all represent inflation (in paper aassets, though not necessarily in consumer prices).

In fact at the time of highest consumer price inflation during the 1970s, the Dow:Gold ratio was falling fast. The previous fall in the 1930s was during a deflation (with the 1933-34 inflationary policy of dollar devaluation accompanying it)! In both cases, stocks fell massively with respect to gold.

The present fall since 2000 has now gone further than this chart shows, to a ratio of 12 (12,000 Dow and $1000 Gold) and hints at serious recession/depression to come. However, it says nothing about whether it is inflationary or deflationary. It merely shows the destruction of financial assets by one form of default or another. Deflation is default through non-payment and bankruptcy; inflation is default through devaluation of the currency and consequent loss of purchasing power of the nominally repaid debt.

I hinted that this may render the inflation/deflation debate somewhat meaningless and these were possible conclusions from the chart pattern:

1. In both cases ('30s and '70s, deflation and inflation), stocks fell massively with respect to gold.

2. The economic instability is increasing with every cycle and valuing anything correctly is becoming impossible, which hints at economic and monetary destruction, possibly at the next extreme of the cycle.

3. This chart pattern is like a positive feedback loop as I described in an earier blog entry. Unlike other chart patterns with trendlines, it is impossible to break out of these expanding trendlines, unless a catastrophic event occurs on the downside or upside. The only option would be to try to stabilise the ratio within these trendlines, near to the mean. The swing is already a factor of x43, so do you think it will be possible to stabilise within these trendlines near to mean, to get the ratio to sit in the original green channel again, under this present monetary system? I don't.

4. With each oscillation, the Dow:Gold ratio is spending less time above the original, stable, slowly rising green trend channel and more time below it. This hints that financial assets in a secular sense are becoming gradually less favoured than tangible assets (gold). It hints at a shift away from trust in fiat money. It might hint subtly that industry and investment in the future might not not be able to function under fiat money.

Now let's look at the Megaphone Top formation again with potential dates added:

So, what's the measured move then? See next posting.

Text Copyright 2008. D. Bellamy.

Thursday 29 May 2008

Inflation/Deflation debate is BUNK! 2008-05-29.

It just is.

Basically, whether we get inflation or deflation, what is relevant is only whether there is creation or destruction of wealth. We seem to be entering an era where there is a likelihood of massive destruction of wealth.

A period of severe inflation or deflation is at hand - and it is the result only of the destruction of wealth that is now happening. A lot of this is concerned with default on debt - the inability to pay down the debt principal or even the interest due on the debt. The cause of this is excessive debt that has built up due mainly to central bank and government policies of inflation of the money supply and the distribution of this excess money into the financial system, into the hands of banks rather than into the hands of those who produce wealth for the economy. In other words, gross malinvestment.

We have entered into a period, proven by the increasing and extreme ampltude of oscillation of the Dow Jones stock index to Gold ratio, where it is becoming impossible to value anything in terms of money, or even in terms of anything else. The entire economic system is completely broken. Many say that the Dow:Gold ratio measures values of paper assets vs real assets. I think that it is only part of the story. In fact, the Dow stocks represent real companies and real productivity and are therefore semi-tangible. Although the stock prices are based on 'faith' or confidence in those companies and are paper assets, their values are also governed by sales, profits, cash dividend payments and other 'real' assets of those companies such as real estate, plant and equipment.

The wild oscillation of the Dow:Gold ratio from 1:1 in 1980 to 43:1 in 2000 is a change by a factor of above 40! This means that, in a fiat money system, the value of one asset is not knowable in terms of another asset within a factor of 40! This is outrageous in a so-called 'stable' economy and is proof positive that the economy is not stable. I think that this huge volatility is a key factor that has been ignored.

Note from my previous blog entries (Chart hints at Financial Disintegration: 2007-12-23) that the instability began in the 1920s, shortly before the USA went off the Gold Standard, but after World War I when many industrial nations had already left the Gold Standard (such as England in 1914). Coincidence? I think not!

Contemporary with this was the Hyperinflation in Germany of 1923 and a short re-emergence of the Gold Standard in England in 1925, unsustainable because of highly inflationary policies during that period.

The 1920s stock market bubble is what led to the first major off-trend high on the chart - and the major low that followed is the early 1930s 90% crash in the Dow Jones, which was followed by the seizure of private gold by Roosavelt in 1933 and the subsequent 40% US Dollar devaluation from $20.67 per ouice of gold to $35 per ounce.

The 1920s stock market bubble is what led to the first major off-trend high on the chart - and the major low that followed is the early 1930s 90% crash in the Dow Jones, which was followed by the seizure of private gold by Roosavelt in 1933 and the subsequent 40% US Dollar devaluation from $20.67 per ouice of gold to $35 per ounce.The above chart is my adaptation of the Dow-Gold since 1800 sharelynx chart, with thanks to Nick at sharelynx for permission.

The bottoms of the Dow:Gold ratio in 1933 and 1980 represent major recessions/depressions, one deflationary and one inflationary. The ratio is oblivious to which. The three tops in 1929, 1966 and 2000 represent the euphoria of stock market/financial manias, regardless of the level of inflation at the time, although they probably all represent inflation (in paper aassets, though not necessarily in consumer prices).

In fact at the time of highest consumer price inflation during the 1970s, the Dow:Gold ratio was falling fast. The previous fall in the 1930s was during a deflation (with the 1933-34 inflationary policy of dollar devaluation accompanying it)! In both cases, stocks fell massively with respect to gold.

The present fall since 2000 has now gone further than this chart shows, to a ratio of 12 (12,000 Dow and $1000 Gold) and hints at serious recession/depression to come. However, it says nothing about whether it is inflationary or deflationary. It merely shows the destruction of financial assets by one form of default or another. Deflation is default through non-payment and bankruptcy; inflation is default through devaluation of the currency and consequent loss of purchasing power of the nominally repaid debt.

So all these people on the Internet 'talking their book' and wasting your time and money getting you to subscribe to their worthless commentaries about deflation vs inflation are giving you worthless arguments. It is all complete guesswork. Half of them will be wrong and you won't know which half until it is done. Probably, they all will be wrong one way or another. I have nothing to sell, therefore I am essentially unbiased. I am just writing this because I am bored!

Only two things are apparent from the chart:

1. In both cases ('30s and '70s, deflation and inflation), stocks fell massively with respect to gold.

2. The economic instability is increasing with every cycle and valuing anything correctly is becoming impossible, which hints at economic and monetary destruction, possibly at the next extreme of the cycle.

...

Now, I have noticed two more things:

3. This chart pattern is like a positive feedback loop as I described in an earier blog entry. Unlike other chart patterns with trendlines, it is impossible to break out of these expanding trendlines, unless a catastrophic event occurs on the downside or upside. The only option would be to try to stabilise the ratio within these trendlines, near to the mean. The swing is already a factor of x43, so do you think it will be possible to stabilise within these trendlines near to mean, to get the ratio to sit in the original green channel again, under this present monetary system? I don't.

4. With each oscillation, the Dow:Gold ratio is spending less time above the original, stable, slowly rising green trend channel and more time below it. This hints that financial assets in a secular sense are becoming gradually less favoured than tangible assets (gold). It hints at a shift away from trust in fiat money. It might hint subtly that industry and investment in the future might not not be able to function under fiat money.

Text Copyright 2008. D. Bellamy.

Bullish De-Hedging news as Gold < $900. 2008-05-29

The first two articles on Kitco today, one is seemingly bearish on the surface and one is highly bullish.

Gold Drops Back Below $900 - NASDAQ, May 29 2008 9:10AM

Gold de-hedging could reach 10m oz in 2008 - Miningmx, May 29 2008 7:24AM

As gold moves under $900 again to $889.70, perhaps to test the previous support around 840-850 (coinciding with the former all time high from 1980), as oil slips below $130 to a new low, low price of $129.81 and the US$ rallies to 72.88 on the Dollar index, we hear from MiningMX the news that up to 10,000,000 ounces could be de-hedged in 2008.

those bearish on the gold market were calling for de-hedging to stop almost as soon as it started, way back in 2002, and many were calling for it to come to a halt and reverse to further hedging when ghold hit highs around $730 in 2006. Not so. They were completely wrong, as they have been all through this bull market in all tangible commodities.

In fact, with the price around $900, Anglo gold Ashanti, we hear on miningMX that » AngloGold raises R12bn to combat hedgebook! This may be accomplished by asset sales and the issue of around 70 million shares. However, this will still leave tnem with over 6 million ounces hedged! This gives some idea of the massive amount of hedging that took place during the gold bear market up until 2001.

Twelve billion Rand is not far off the $2bn US$ that Newmont spent to eliminate all its hedges not long ago, taking a large hit in the process. Since then, Newmont's profitability has seen an impressive increase.

Monday 26 May 2008

Gold:Oil ratio to fall at Peak Oil? 2008-05-26

On the questions section on http://www.financialsense.com/ here: Mp3, one of the callers (Justin) made a very astute question asking if Peak Oil was the possible cause of the fall in the gold:oil ratio to 7 from its long term average of 15 and its medium term recent average of 10. Jim answered the question saying that Peak Oil is likely to be part of it and the undervaluing of gold is another major part of it. He used it as a prodictor for a big upmove in gold in the near future but gave no real fundamental or market justification for this, for instance related to supply and demand.

I think Justin hit the nail on the head. He even went to mention that the only other time in trading history that gold:oil was at 7 was 33 trading days, all in 2005. Of course, he said this to imply the connection to Peak Oil, because it seems to be established that the peak in conventional oil production occurred in May 2005. That's surely too much of a coincidence to be ignored. I have already mentioned this possibility in a previous blog entry (Oil to $1000 per barrel?) but Justin the caller asked the question in a particularly clear way. Unfortunately, Jim didn't give quite enough attention to answering this question, in my view. I think it was an important concept. However, he does such a great show with so many ideas in it and it is always worth a listen!

I see no reason why the ratio should not reset to a lower level for quite a time, for instance to 7:1. I actually mentioned that if oil reached $1000 a barrel, gold would be $5000 if the ratio was only 5:1!

Take the example of the gold:silver ratio. This has historically been 15 or 16:1 as set by Sir Isaac Newton in the 1700s and the free market over millennia. The ratio returned to this in the panic buying in 1980 with gold at $850 and silver at $50 but has spent decades since 1980 much higher, even as high as 75:1. Right now, it is 926.50/18.26 = 50.7. This ratio has been away from the historic average for more than 20 years!

Saturday 24 May 2008

Oil to $1000 per barrel? 2008-05-19+

Monday 19th May 2008, 8:34 p.m. : Oil will be $1000 per barrel before 2020.

Oil will go to $1000 per barrel.

Before 2020.

Everything points to that, including and especially government policies.

It's only my opinion. See if it's correct.

I recommend listening to the first hour of Jim Puplava's 24 May 2008 Financial Sense Newshour at http://financialsense.com/fsn/main.html. Here is the Mp3 - the relevant section on oil is the third quarter from about 40 minutes to 1 hour 3 minutes with Bill Powers and Jim Puplava.

I have started my Oil blog with this post too: Oil will be $1000 per barrel before 2020. 2008-05-19+.Next Leg of Credit Meltdown? 2008-05-24

I am just listening to Frank Barbera talking with Jim Puplava (this Mp3) on the www.FinancialSense.com newshour.

He mentioned some of the American banks and monoline insurers so I went and took at look at the charts. Oh dear! This looks a bit like February 2007 and August 2007. There are some spectacular losses and some charts positioned for potential major breakdowns from multiple price bottoms. See these!

Ambac:

http://uk.finance.yahoo.com/q/ta?s=ABK&t=2y&l=on&z=m&q=c&p=m20,m50,m200&a=vm,r14&c=

Bank of America:

http://uk.finance.yahoo.com/q/ta?s=BAC&t=2y&l=on&z=m&q=c&p=m20,m50,m200&a=vm,r14&c=

Citicorp:

http://uk.finance.yahoo.com/q/ta?s=C&t=2y&l=on&z=m&q=c&p=e20,e50,e200&a=&c=

Lehman Brothers:

http://uk.finance.yahoo.com/q/ta?s=LEH&t=2y&l=on&z=m&q=c&p=e20,e50,e200&a=&c=

In the UK, Halifax Bank of Scotland (BBOS) compared to Lloyds TSB and HSBC - nice downtrend - Slide, Charlie Brown, Slide!

http://uk.finance.yahoo.com/q/ta?s=HBOS.L&t=1y&l=off&z=m&q=c&p=e50,e20,e50,e200&a=&c=hsba.l,lloy.l

It's interesting to compare these to some oil drillers:

Diamond Offshore:

http://uk.finance.yahoo.com/q/ta?s=DO&t=2y&l=on&z=m&q=c&p=e20,e50,e200&a=&c=

Chesapeake Energy:

http://uk.finance.yahoo.com/q/ta?s=CHK&t=2y&l=on&z=m&q=c&p=e20,e50,e200&a=&c=

Tullow Oil (UK) vs the OIL ETF:

http://uk.finance.yahoo.com/q/ta?t=2y&s=TLW.L&l=off&z=m&q=c&p=m20&p=m50&p=e200&c=oil

... one of the very few oil companies to be outperforming the price of oil! The 20+% gap up in the Tullow Oil share price apparently coincided with the announcement of a 600 million+ barrel doil discovery off the coast of Ghana.

It looks like Leg 2 (or is it 3?) of the credit crisis and accompanying hyperinflationary depression is underway.

Thursday 22 May 2008

Gold s Outlook back to $650-$750 area by Victor Adair

that refers to this 'interesting' gold bearish interview:

http://www.howestreet.com/index.php?pl=/fbn/index.php/mediaplayer/277

My comment was posted here:

Re: Gold's Outlook back to $650-$750 area by Victor A ...

Nadler says that Indian gold demand was down in 2007. I thought it was a record! See this article for instance:

http://www.thehindubusinessline.com/2008/01/02/stories/2008010250091300.htm

It was already 689.7 tonnes by the 3rd Quarter, then it was down in Q4 2007 because of the high price. Projection on this article was 110 tonnes in Q4 2007 giving a total of 800 tonnes for 2007. However, wasn't it still a record? Nader says it was down a lot from the previous year. I think this is rubbish, but I am not 100% sure.

OK, so Indian demand was very low in January 2008 and low in Jan-Mar 2008. It was also very low in early 2006 just the same during the spike up to $730. The next year was a record if I am correct. So they bought more in 2007 at an average of £$650 than in 2001 at an average of $270!

This Nadler guy is a perma Fed bull and a gold bear. Maybe jewellers don't like expensive gold because it erodes their premiums! That is true for semi-numismatic coins. The premiums tend to erode as the price spikes. For jewellers, falling premiums = falling profits. I think we are seeing the gold users calling for a top in gold because the high gold price erodes their profits.

Re: Gold's Outlook back to $650-$750? 2008-05-22

Wednesday 22nd May 2008: 6:01 p.m. Nothing better to do... so I posted on Yahoo!

Another comment from me to this posting:

Gold s Outlook back to $650-$750 area by Victor Adair

that refers to this 'interesting' gold bearish interview:

http://www.howestreet.com/index.php?pl=/fbn/index.php/mediaplayer/277

My comment was posted here:

Re: Gold's Outlook back to $650-$750 area by Victor Adair which hasplenty of debate about John Nadler's commentaries.

OK, OK, so John Nadler had his little speech about $740 being the 'clearing' price for gold and his original forecast for this year was an average of $740 I believe, so let's see if he's right. Or maybe it was $840, who cares? So far, it hasn't got within $100 above 740 from the topside, so it looks very unlikely that he is going to be within +/-$200 with his forecast. I did though see a double H&S potential in gold that would take it back to $600 but is that likely to materialise? NO. I pointed it out here: http://1000gold.blogspot.com/2008/04/blog-post.htmland a 68% Fibonacci retracement of the entire bull run from 300 or so would point to the same, if we got a similar pullback to that of 1974-76, which was very close to a 68% Fibobnacci pullback from £198 to £103 after the original rally from £42.22 in 1971: http://1000gold.blogspot.com/2008/05/fibonacci-points-to-600-gold-re1974.html... but really, is this 1974? NOT LIKELY! http://1000gold.blogspot.com/2008/05/fundamentals-dont-point-to-gold-at-600.htmlWe do have the start of out of control inflation like in 1974 (and an oil crisis) but our economy cannot even stand interest rates over 5% or it will bust. What is the chance of slowing this inflation down with interest rates under 5%? Virtually nil, of course. Oil is at $133; everytime you look away for a minute, it has gone up again. It might blow off at $200 and come back down for a while (it's not likely ever to be under $100 again, is it?) but once Peak Oil is recognised, it will go to $1000 I think. Even with a poxy 5:1 gold:oil ratio, that would give $5000 gold. With peak oil, I think the gold: oil ratio will fall from its historical above 10 ratio for a while. If a real crisis hits in the next 10 years and oil is rationed worldwide or seized for military use as Jim Dines predicted on last weekend's http://www.financialsense.com/ interview with Eric King, then no-one will take fiat money for oil and gold and silver will be remonetised for oil purchases at that point. Only an opinion! Nadler is stuck in the Year 2000 gold bear market thinking of it as only jewellery. He is 8 years behind the curve already. True, jewellery demand is still a kind of important factor (at the moment) but getting less and less so all the time, as the monetary metal factor will increase relentlessly from here on. Why even bother to read John Nadler?

Monday 19 May 2008

Interesting & VERY TELLING Inflation chart. 2008-05-19

Gold has mounted a nice rally past $900 since late last week, with decent up moves, especially last Friday and today. Current spot market price shown on Kitco is Bid/Ask = 905.10/905.90.

Now to an article by the highly instructive and perhaps more 'mainstream' writer John Mauldin, entitled The Fed at the Crossroads. His fairly extensive articles are an interesting read because they don't contain the invective that often comes in gold bug type writings but they can sometimes paint a telling picture of the situation from someone I would view as being pretty much unbiased.

In the section 'Accounting for Inflation' he shows a graph taken from data originally published by Walter John Williams' http://www.shadowstats.com/ website and drawn by Matt Perry of the Union Tribune (according to the graph) showing annualised inflation figures from 2001-2008, according to the opre-1983, pre-1998 and present methodolgies. If you ever had the slight suspicion that governemt statistics were perhaps a little bit out of touch with the reality of wildly rising prices, take a look at that graph! Similar home truths might be found if a serious economist (one not financed by government grants to a university but a real world private economist) looked at UK inflation data.

Current inflation calculation method gives 4.0% annual inflation on the CPI, pre-1998 method gives 7.3% and pre-1983 method gives 11.6%! Of course, the pre-1983 method was the one that gave those 20% figures on a couple of occasions during the 1970-1980 period, especially around 1973-74 and 1979-81. The figure of 11.6% is well on the way to 20. And it shows inflation as being over 8% for almost all of the period 2001-2008, even while the Fed was talking of the danger of 'deflation' in 2001-2002.

I remember UK inflation being about 8% in 1978. That was about the low for the mid-'70s between the spikes to 20%+ in 1974 and 1980 or thereabouts.

It looks like we are in the 1970s all over again, without the rising wages, as I have mentioned in previous articles, such as that of Wednesday 31st October 2007: Wage-Price Spiral, without the rising wages!

Thursday 15 May 2008

Inflation - media pick new lower CPI vs RPI figure!

Let's go and have a look at the Office of Natiopnal Statistics' website, where they helpfully explain these indices. That is nice and open of them, but you don't hear about it on the TV news, do you? Latest On CPI and RPI shows clearly why CPI is now quoted instead of the RPI. It's a lot lower!

Elsewhere, the Guide to Finding CPI/HICP Data explains that the CPI is the same as the HICP, the Harmonized Index of Consumer Prices, which appears to be a standardised interntational inflation index (presumably one that understates inflation everywhere)! I am fairly sure that I remember an old free handout, the HSBC Economic Bulletin that I picked up from the bank regularly a few years ago that mentioned the HICP and gave a graph of the HICP (CPI) vs the RPI. The RPI was then at about 2.9% and the CPI was at about 1.9%. In other words the CPI was a third lower!