Monday 6th September 2009 5:03 pm:Inflation Deflation debate on financialsense.comBon Prechter the archetypal deflationist was interviewed by Jim Puplava on

http://www.financialsense.com/ this Saturday. Very interesting. He admitted that he hadn't expected that there would be one last 'final' reinflation after the recession of 2001 (he had expected the deflaiton to start in 2000-2001), but he was convinced that the events of 2007-2009 were exactly what he had predicted in his book 'Conquer the Crash' many years earlier. The book has been updated for a new edition and is going to print, by the way.

Jim Puplava is going to interview two inflationists followed by one more deflationist in the following couple of weeks. If they are as good as Prechter's interview then they will be very informative and intellectually stimulating.

Myself, I wonder if we are going to see something different from the big hyperinflaation or big deflation that the inflationists and deflationists are touting.

I think it is possible that we might see alternating periods of inflation and debt deflation, because we have actually seen this already:

1980s-2000: Long term bull market in stocks, bonds and property with few interruptions.

2000-2003: Small debt defaltion and falling asset prices, stock market crash.

2003-2008: Massive inflation in debt instruments and derivatives, very low interest rates at 1% , huge property bubble, commodities rising, price inflation, rising stock markets, some to new highs.

2008-2009: Larger debt deflation, banks bankrupt, financial panic, stock market crash.

2009-now: Massive injections of liquidity into bankrupt financial systems, ultra-low interest rates of zero-0.25% in USA (similar to Japan in late 1990s to present day). So what happens next?

These periods coincide almost exactly with stock market rises and crashes.

1) Liquidity injections not sufficient to offset debt collapse and asset deflation: result, another banking crisis and deflation, possibly hyper-deflation and comlete deleveraging of economy.

2) Liquidity injections sufficient to prevent debt collapse, possible spillover into many asset markets and consumer prices: resulting high inflation or even hyperinflation.

No-one seems able to give a really convincing argument to back either of the above cases, possibly because nobody knows the answer!

I have a feeling that we might be in a new stock bull market that could take us to yet a new nominal high in the Dow Jones, as per 2003-2007, or to a high in the 14000 area. However, Prechter's argument is that there has been a socio-economic change in 2008 that makes this impossible and people are not going to take on more debt.

The large increase in the savings rate agrees with Prechter, as did the rally in the US dollar in 2008 that corresponded to the unwinding of the 'synthetic dollar short position' that the deflationists were postulating before this event. The deflationists were correct: dollars were raised in a hurry to pay off debts and to refill destroyed bank reserves, resulting in a very sharp US dollar rally in late 2008. In that case, we see either a low trending market or another crash coming soon because deflationary forces could be dominant. Many inflationists (even very clever ones such as Jim Sinclair) scoffed at the synthetic dollar short position argument, but it did happen!

My feeling is that, since there is no convincing argument to determine whether the Federal Reserve, the ECB and the Bank of England can re-ignte inflation to balance the deflation which is the natural process that would happen in their absence, then we might be in for alternating periods of inflation and deflation, which might increase in amplitude as the debt collapse continues.

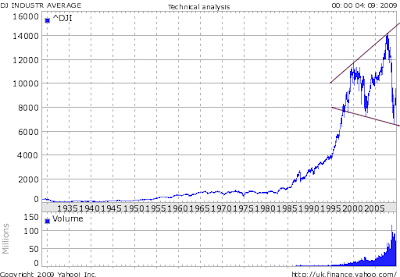

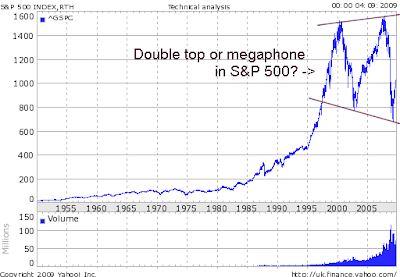

I note that the stock market, well the Dow Jones (and the S&P500) anyway, made a high in 1999-2000, a low in 2003, a higher high in 2007 and two slightly lower lows in 2008-09, we have another possible megaphone formation in progress, much like the megaphone in the Dow to gold ratio that has been forming since the 1920s. In other words, the market values of assets are increasing in uncertainty as this crisis unfolds, possibly leading to a catastrophic collapse at the end of this period.

Bob Prechter is expecting a major deflation in the 2010 timeframe, larger than the one in late 2008, once the present 2009 inflationary episode is over. In his view, the Fed's purchases of non-performing assets in 2008-09 will not generate inflation because they were more or less targeted as loans to specific institutions to replace the non-performing assets with existing Treasury bonds, rather than freshly 'printed' money, as I understand it. And when more assets fail, such as in the commercial real estate, prime mortgages and leveraged buyouts, many more defaults will come and deflation will continue, sending markets to new lows.

Here are two of my previous blog posts before last year's panic:

Inflation/Deflation debate is BUNK! 2008-05-29.Thursday 29th May 2008: Inflation/Deflation debate is bunk.

and

Megaphone top in Dow:Gold ratio? 2008-06-03Tuesday 3rd June 2008: Megaphone Top in Dow:Gold ratio?

Charts for new post:

Dow Jones megaphone:

S&P 500 megaphone? :