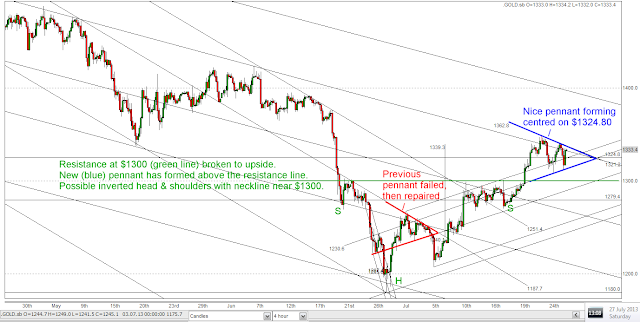

The pennant is shown in blue and is working nicely right now as of Friday's close. I also spotted just now an inverse head and shoulders with neckline at around $1300 and this has already broken out to the upside:

Pennant:

Measured move:

1356-1297.6=58.40

Target:

1356+58.4=1414.40

Inverse Head & Shoulders:

Measured move:

1300.70-1180.0=120.70

Target:

1300.70+120.7=1421.40

This is fascinating, because this would take the price close to the quadruple top resistance from the end of 2010 at and below $1430, where the market rolled over (and maybe there was distribultion) before the big move to $1920. There is also resistance at about $1421 from the last rally top in late May, so there is strong resistance near my rally target. It seems a natural stop off point.

I think that $1430 and $1530 (where there was previously support from late 2011 to April 2012) will be the big obstacles for gold's current recovery rally.

I am potentially liking the current chart for a move to $1410-1420, contingent on this pennant's not breaking down like the last one did (see red pennant on chart),

[There was a 'false' breakdown from the red pennant, which was later repaired. Interestingly that pennant was also linked to a sloping inverse head and shoulders that had its neckline along the upper line of the pennant in that case The target for this first, sloping inverse H&S was $1339.30 and gold has already reached that far.]

No comments:

Post a Comment