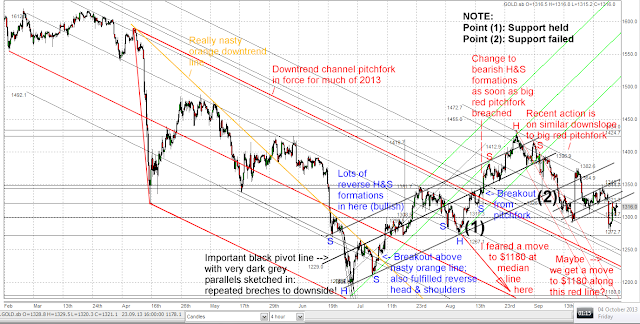

So what now? Something like this?

I drew the first downmove too steep so that it would reach the downsloping parallel, which is probably too low anyway. But it is just a whimsical notion.

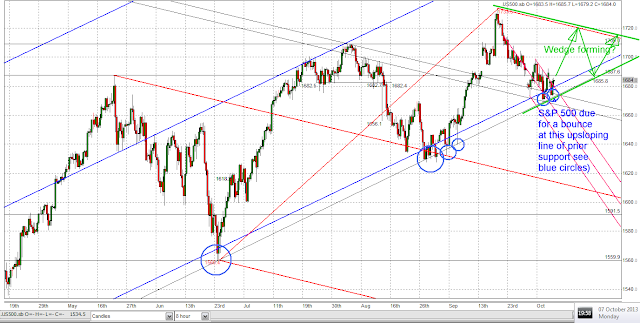

The longer term chart shows that all of the uptrends are still intact and marks the pennant:

If the S&P is reversed to the downsidefrom this owntrend pitchfok is in action level, it could mark the point where a pennant is forming and the proposed red downtrend pitchfok is now coming into play There could then be a fight between the bulls and bears: between the long term blue uptrend channel whose support has been slipping a little and this new downtrend slope. I saw this downtrend first described in a coghlancapital free webinar and on the market calls section of his excellent website.

Currently, the very long term (4 year) uptrend marked in orange has shown no slippage - the price bounced twice recently on one of the orange parallels that you can note was previously resistance, just before the first of the recent major highs was made. In fact, that parallel forms the lower line of the green pennant that may be coming in. This parallel is also delineated by a major price high over 2.5 years ago and should therefore be strong support. The parallel beneath it goes back 3 years and has clearly gone from resistance to support over the last year or so.

I love charts! :-)